Cathedral City

Visitors come for the resorts and restaurants, majestic mountains, desert flora, and scenic golf courses while its numerous festivals make them want to stay.

Join us Downtown

Come Join us

CATHEDRAL CITY, CALIFORNIA

Moving Cathedral City Forward

with Commitment, Pride & Excellence

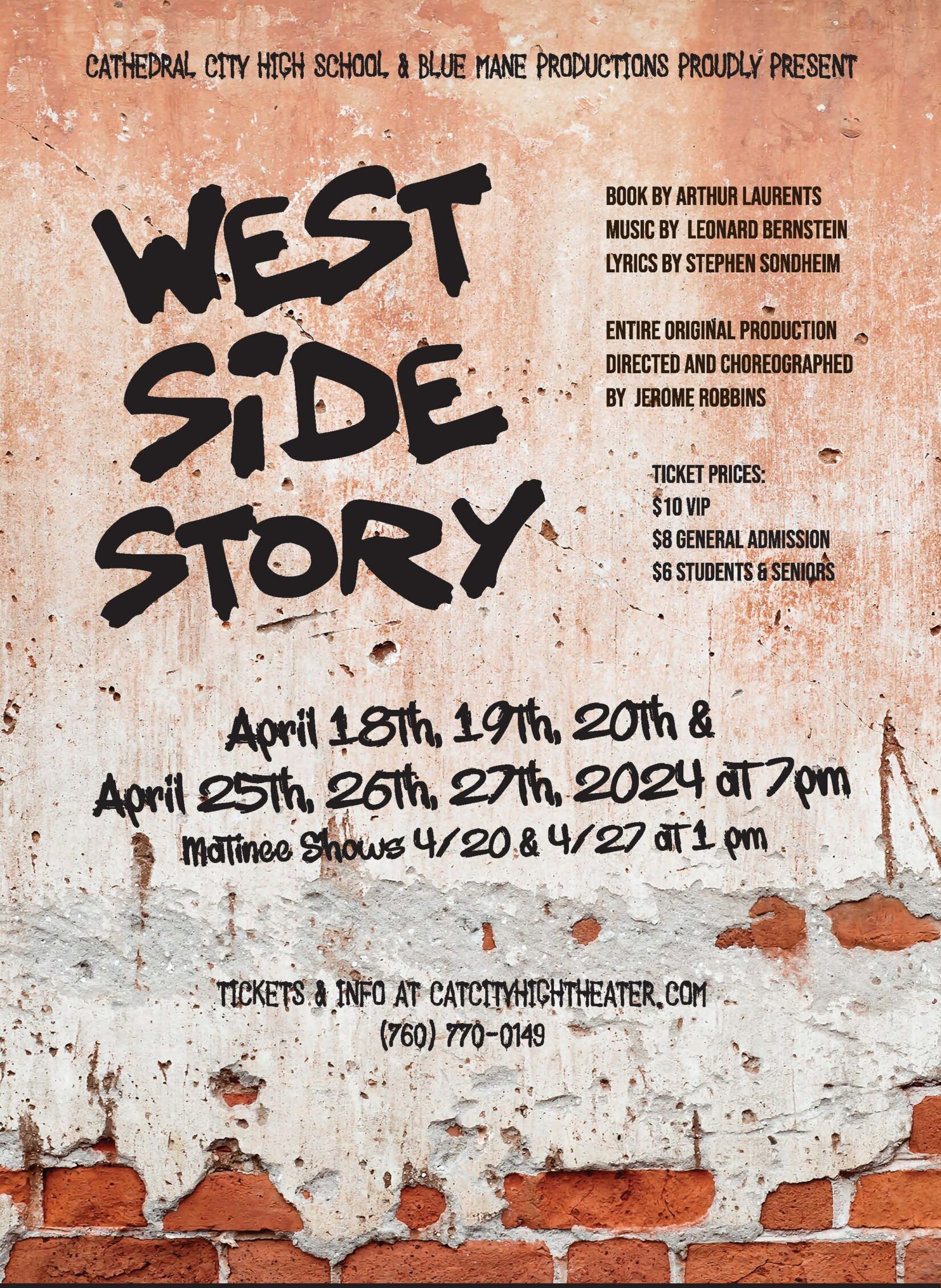

EVENTS

Subscribe to Our Newsletter

NEWS

Cathedral City’s Discover Digest

Discover Cathedral City's Discover Digest weekly newsletter. Subscribe to Discover Cathedral City. Continue reading→

Beat the Heat This Summer at Cathedral City High School Pool Through City’s Joint-Use Agreement with DRD, PSUSD

Beat the heat this summer at Cathedral City High School pool! The City Council of Cathedral City has once again approved a three-party joint-use agreement between the City, Palm Springs Unified School District and Desert Recreation District... Continue reading→

CONE ZONE ALERT: FY 2023-2024 Spring Rubberized Emulsion Aggregate Slurry (REAS) Projects

NOTICE OF CONSTRUCTION The City Council of Cathedral City awarded a construction contract to Petrochem Materials Innovation, LLC. (PMI) in the amount of $1,114,598.46 for the construction of the FY 2023-2024 Spring Rubberized Emulsion Aggregate... Continue reading→

Coachella Valley Repertory Announces 2024 Summer Cabaret Series in Downtown Cathedral City

Grand performances, great music and personality-plus make the COACHELLA VALLEY REPERTORY 2024 SUMMER CABARET SERIES among the very best ways to enjoy Downtown Cathedral City. CVRep has scheduled 17 memorable evenings of award-winning talent, vivacious personalities,... Continue reading→

Cathedral City’s Discover Digest

Discover Cathedral City's Discover Digest weekly newsletter. Subscribe to Discover Cathedral City. Continue reading→

Greater Coachella Valley Chamber of Commerce to Host 2024 State of the City Business Awards & Expo on May 14, 2024

The Greater Coachella Valley Chamber of Commerce, in partnership with the City of Cathedral City, invites you to attend the 2024 Cathedral City State of the City Business Awards & Expo. This year’s theme will be... Continue reading→